SCCER-HAES CAES Analysis of use-case combining secondary frequency control and price arbitrage

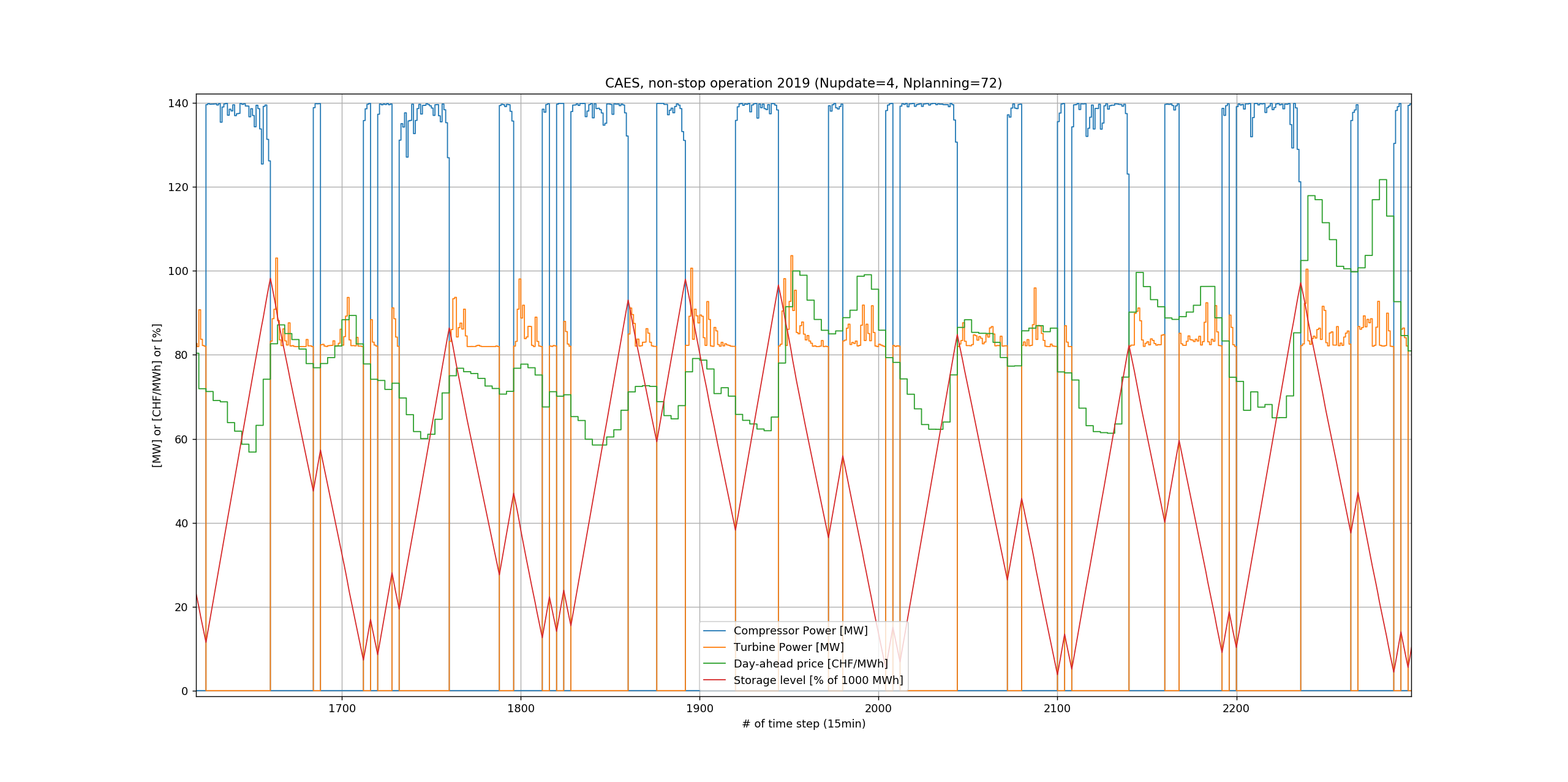

To see the potential as a stand-alone plant, the project investigates a continuous compressed air energy storage (CAES) operation for arbitrage in combination with the secondary reserve market.

An optimization of the CAES operating in the reserve market using the 2019 data (Swiss procurement and deployment of secondary reserves) is performed to assess the economic potential.

A potentially attractive use case for a Swiss compressed air energy storage (CAES) plant is participation in the secondary reserve power market. However, the CAES has only limited flexibility of the operating range (e.g. between 80 and 100 % of nominal power for charging and discharging).

Therefore, the reserve market operation is combined with a continuous operation in the bulk energy market (use case of energy arbitrage).

A scheduling tool with a heuristic to select the binary on/off decisions to run the CAES has been developed and tested in the 2019 secondary frequency reserve market [Tool: in-house MPOPF and storage scheduling tool using Python/Gurobi]:

- Continuous arbitrage operation

- Full price prediction available

- Receding horizon: planning for 72 hours, updated every 2 hours

- Heuristic to avoid mixed integer operation:

- Charge cheap, discharge expensive

- Aim for medium storage level

- Clip and adjust schedule when storage bounds are potentially violated

- Preserve storage level buffer for reserve deployment