SCCER-FURIES Markets

- Assess the possibly benefits of Switzerland joining a European wide electricity market

- Quantify the improvements achievable from switching from existing NTC coupled markets to flow-based coupled

- Evaluate the benefits of enhanced RES forecasting and international reserves procurement

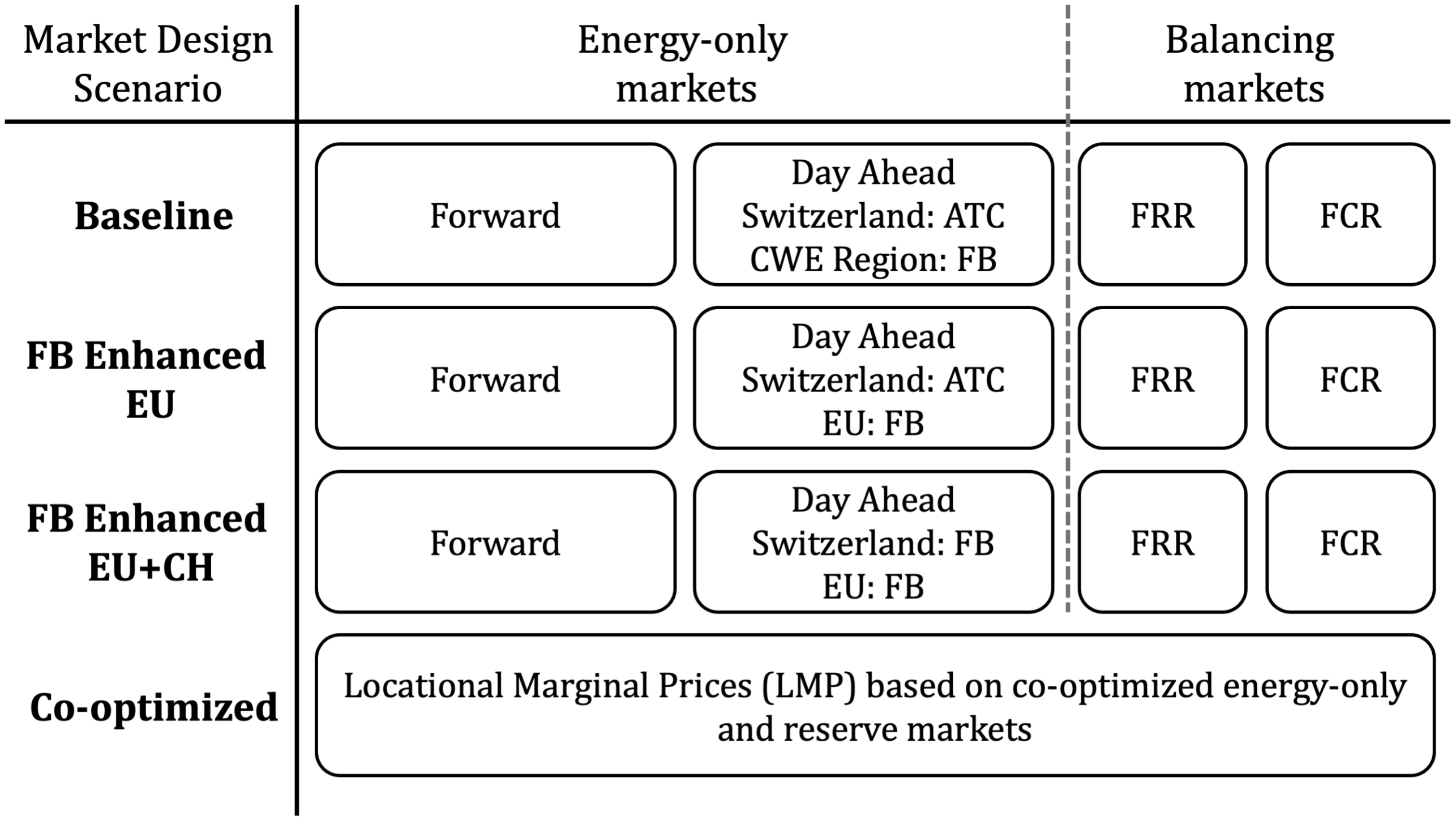

In this work, several different market designs will be simulated and compared to assess the economic potential of future market mechanisms. In all simulated future scenarios, the transition of the Swiss generation fleet is specified to reflect the achievement of renewable target goals outlined in the Swiss Energy Strategy 2050, namely the incorporation of around 21 GW of PV capacity and the phase-out of all nuclear capacity. The results of this project will illustrate the possible economic benefits of a market transition for future scenarios based on a 2050 year. The scenarios considered cover four different market structures.

- European electricity markets are starting to build more advanced connections (i.e. market coupling)

- Market coupling could improve the market efficiency, reduce production costs, and reduce consumer costs

- A benchmark is needed for a centralized co-optimization of the Central-European system

Currently, the operation of the Swiss and European electricity system is coordinated via multiple parallel markets and distributed between national grid operators. Given the ongoing coordination between countries (i.e., market coupling), the expected future adjustments or new markets (i.e., flexibility or capacity markets), and the general increase of intermittent generation, a proper evaluation mechanism is needed to provide a quantitative assessment of the Swiss and European electricity markets. In this work, we aim to investigate the potential economic benefits of enhanced market coordination mechanisms (i.e., market designs) for future scenarios involving the penetration of renewables, prediction uncertainty, and available control structures using the models already developed and benchmarked within this workpackage.

Two modeling frameworks are developed and applied in this project:

- The first, a co-optimized market design model (optMark), has been developed that combines a nodal structure for the energy-only market with a reserve market. In optMark, the hourly dispatch decisions are centrally made by solving an optimization problem using the marginal generator cost functions. We include the intertemporal coupling between time steps (e.g., changes to and limits of the water levels in reservoirs) and solve a multi-period problem over the full year as a single optimization. In this way, we calculate the optimal generation schedules that maximize the social welfare. We consider the well-known DC approximation for power flows.

- The second, a sequential market-based clearing model (eMark), simulates a market-based clearing of electricity and reserve supply offers and demand bids. This module is designed to mimic the actual sequential structures and timing currently employed to clear all electricity market products. Another critical aspect of eMark is that it applies realistic intra-zonal trading limits for each border that reflect the current market coupling mechanisms (i.e., either ATC-based (ATC) or flow-based (FB)). ENTSO-E is currently composed of numerous market zones with some ATC coupling and some FB coupling. eMark is structured to enable simulation of any combination of ATC and FB coupled market zones. In this way, eMark is able to reflect the current mixture of market coupling mechanisms as well as possible future enhancements, which is the focus of this work.

In this project we compare the economic impacts of four different market designs, as shown in the Figure. The first three market designs comprise a traditional market structure divided into forward, day-ahead and balancing markets. They differ in their day-ahead market couplings (ATC-based or FB coupling) that depend on the status of whether Switzerland will achieve a bilateral agreement with the EU. The fourth design represents a co-optimized nodal market structure where all energy and reserves are cleared simultaneously.

The external page paper summarizing the project results

Partners: ETHZ (FEN), ETH (LEC), Swissgrid

Duration: 01/2017 - 12/2020

Funding: CTI

Project Leader: Subtask of SCCER-FURIES WP2 (lead by ZHAW)

Project Team: Dr. Jared Garrison, Dr. Turhan Demiray

external page SCCER-FURIES website